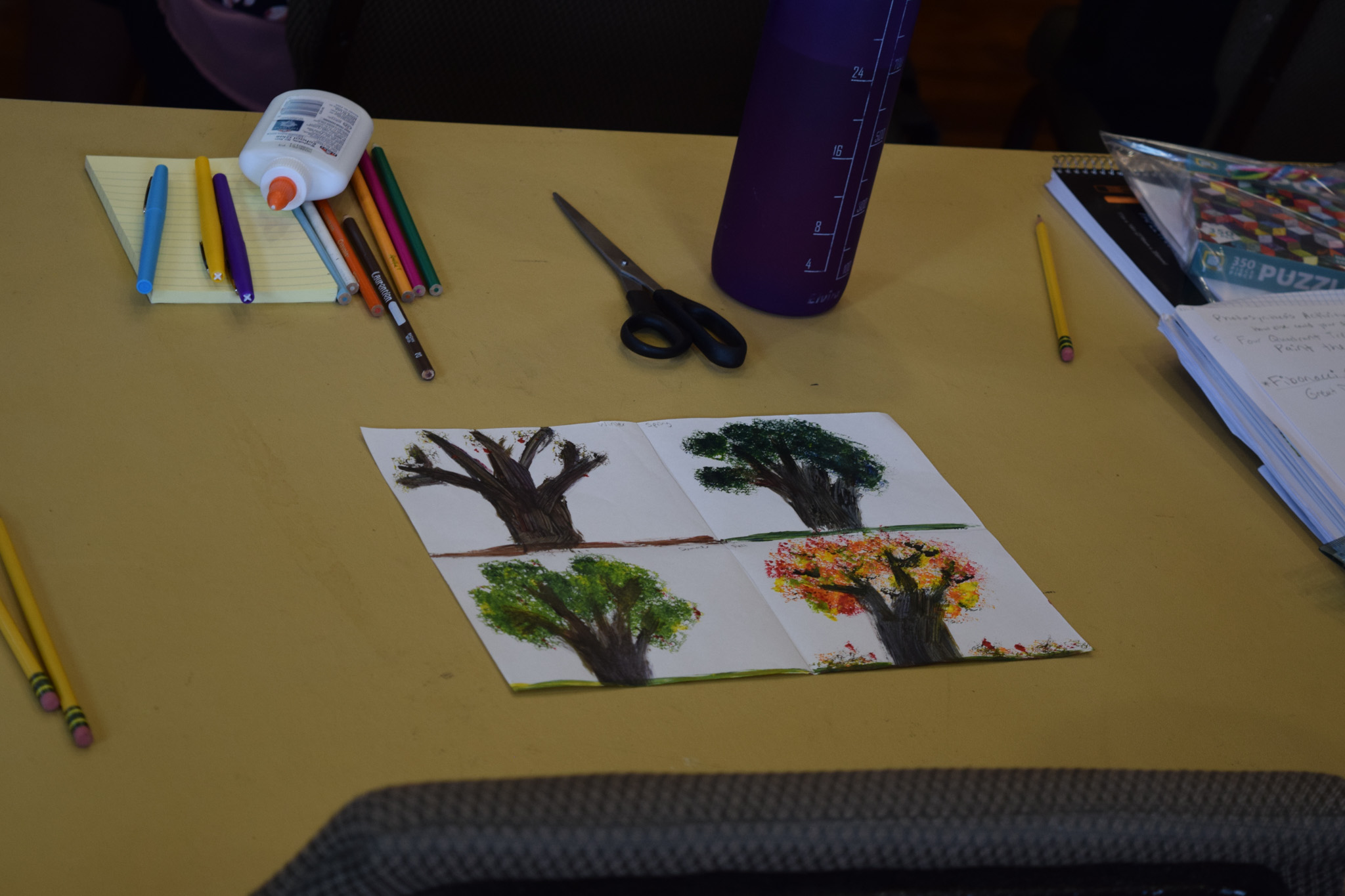

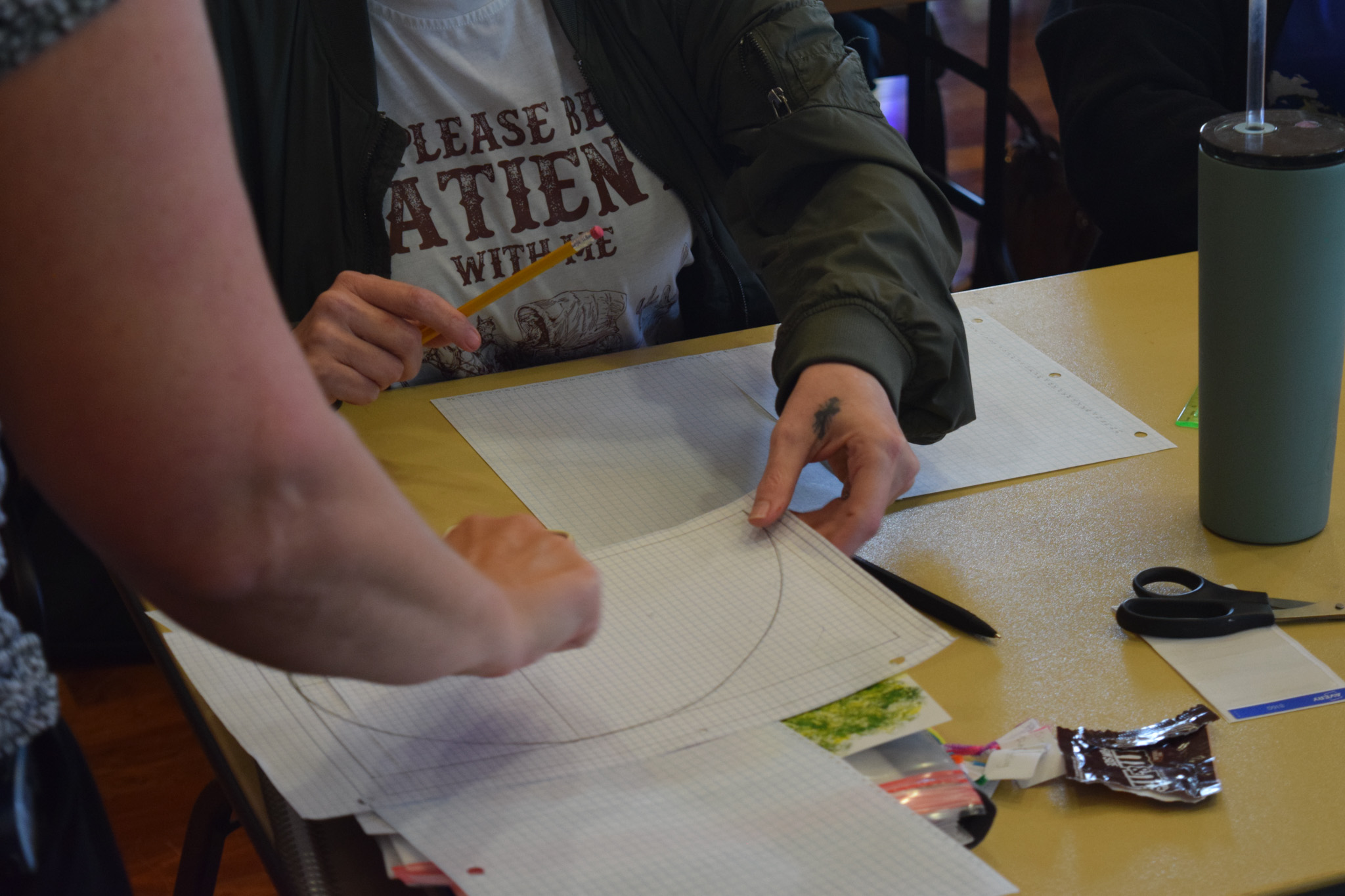

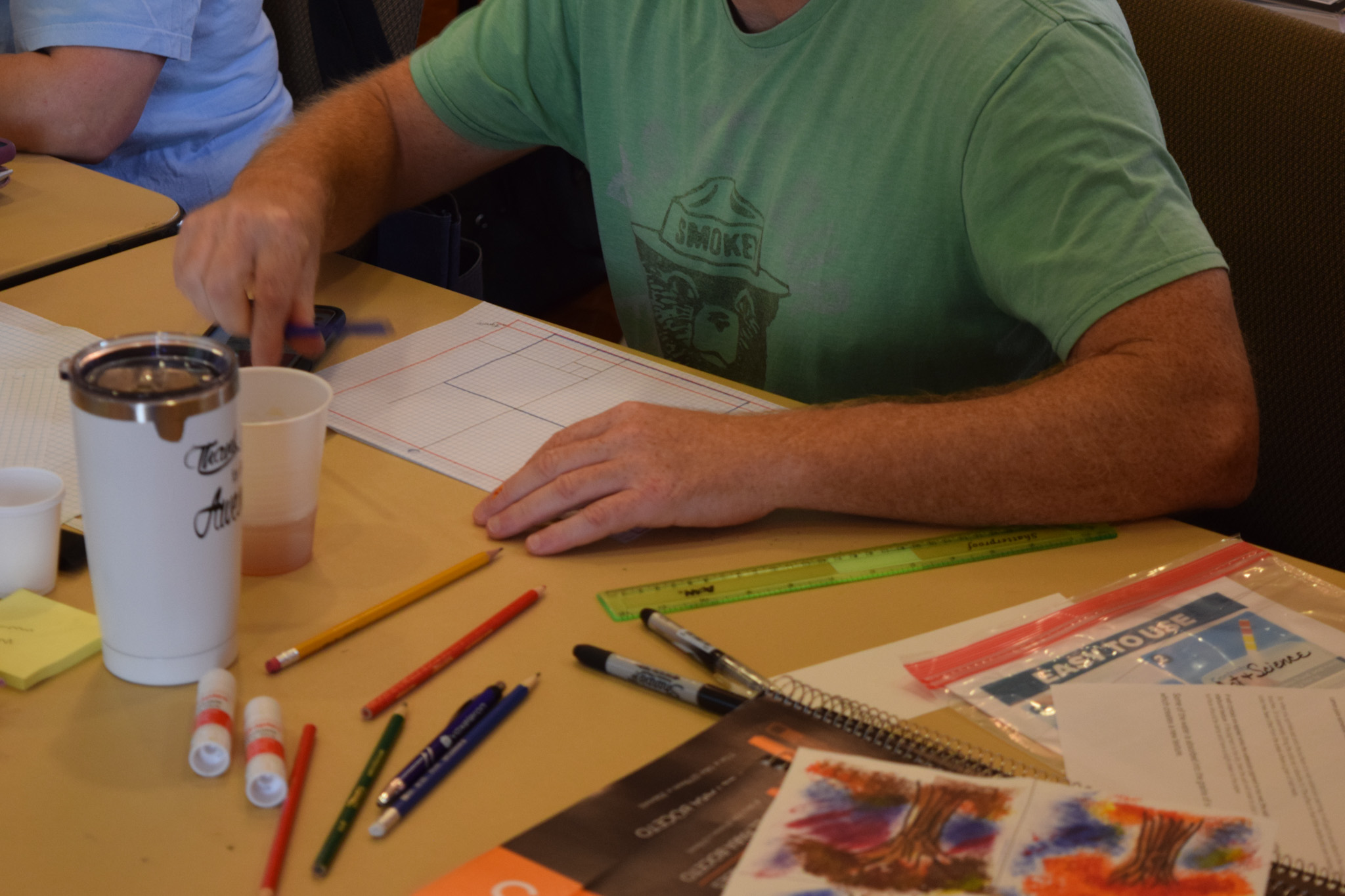

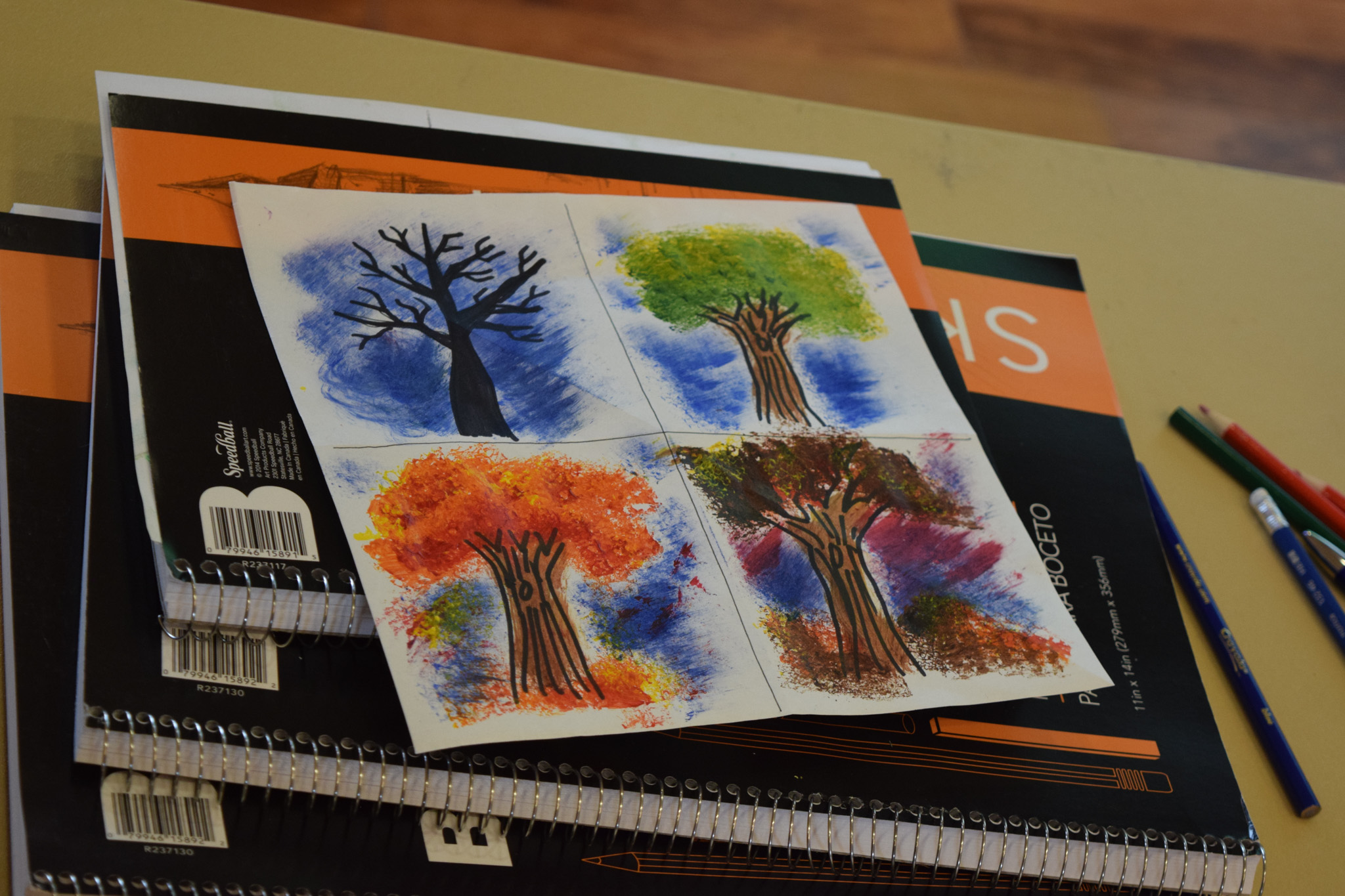

25 Jul Ketcherside Arts Symposium Day 1 Photos

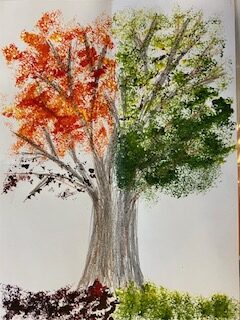

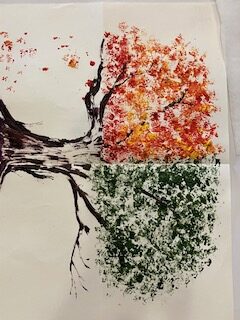

Today marked the beginning of the Ketcherside Arts Symposium. The event, attended by teachers from all over the state, aims to provide a learning experience for teachers to take back to their classrooms. [gallery ids="5727,5720,5721,5722,5723,5724,5725,5726,5728,5729,5730,5731,5732,5733,5734,5735,5736"]...